Guide to Easy Usage

If you are interested in using our fully-digital, zero-contact Secure File Portal, please review the following information which will walk you through the process.

1. Send an email to susan@susandoestaxes.com requesting access which will create a custom account and simplified tracking of your information and return. Please include your name (first and last) and your best phone number for contacting you. This will be used to help with the registration process email.

ex/ “Hi, Susan! I’m ready to send you my tax documents. Please send me information at murph_d_moose@mooseville.com. Murph D. Moose. My number is (403) 555-3689”

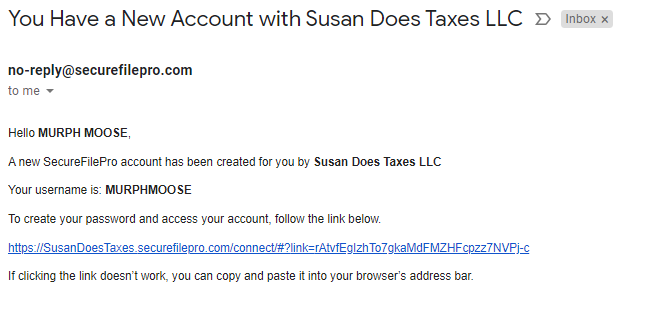

2. Open your email from Susan via no-reply@securefilepro.com.

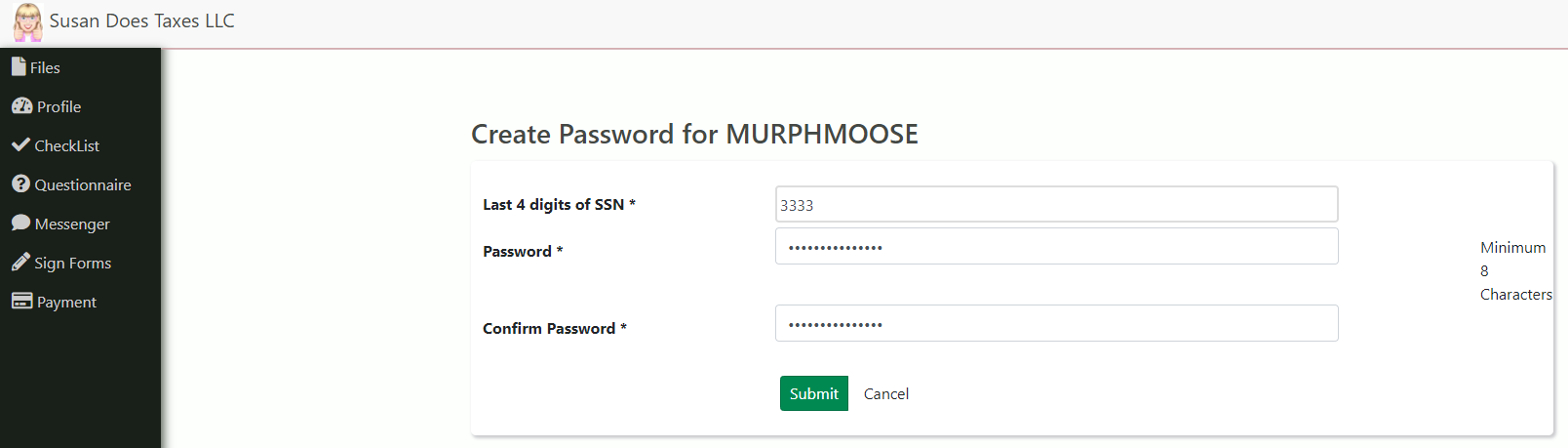

3. Follow the link and instructions within the email. You will be directed to susandoestaxes.securefilepro.com and the record creation page. Enter the last four digits of your Social Security Number, password (a minimum of 8 characters is required), and confirmation of your password. Take note of your unique username as that will be necessary for accessing the Portal. When ready, select Submit. IF you see an error at the top of the page (http failure response for https://securefilepro.com/sfpapi/api/ActivateClient/IsBusiness?Link=rAtvfEgIzhTo7gkaMdFMZHFcpzz7NVPj-c&AccountNumber=0: 417 Expectation Failed) please disregard and proceed as directed.

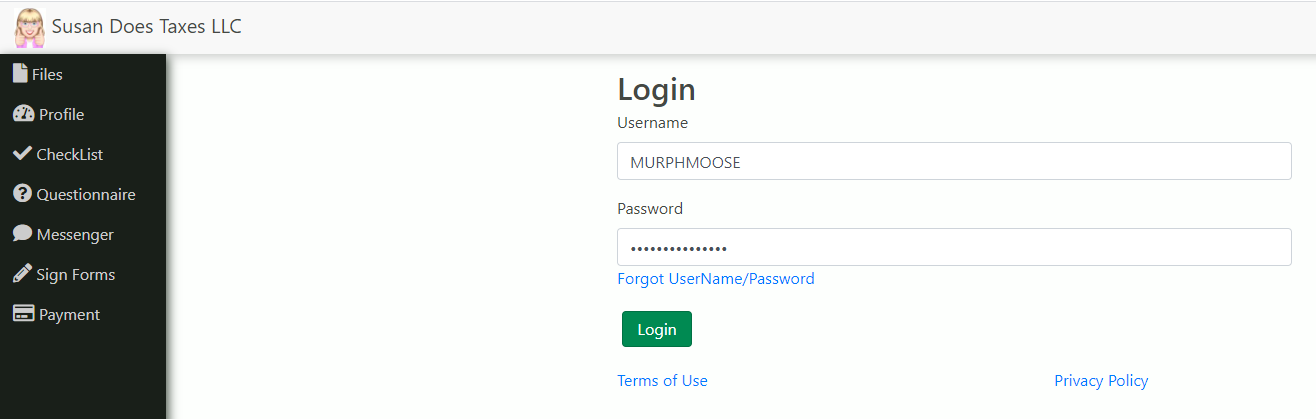

4. The login page will appear and should have your Username automatically filled in from the previous screen. If not, please type in the unique username from Step 3 AS IT WAS SHOWN (case-sensitive). Enter your password and select Login. If by chance your password will not work, follow the Forgot Username/Password link and instructions.

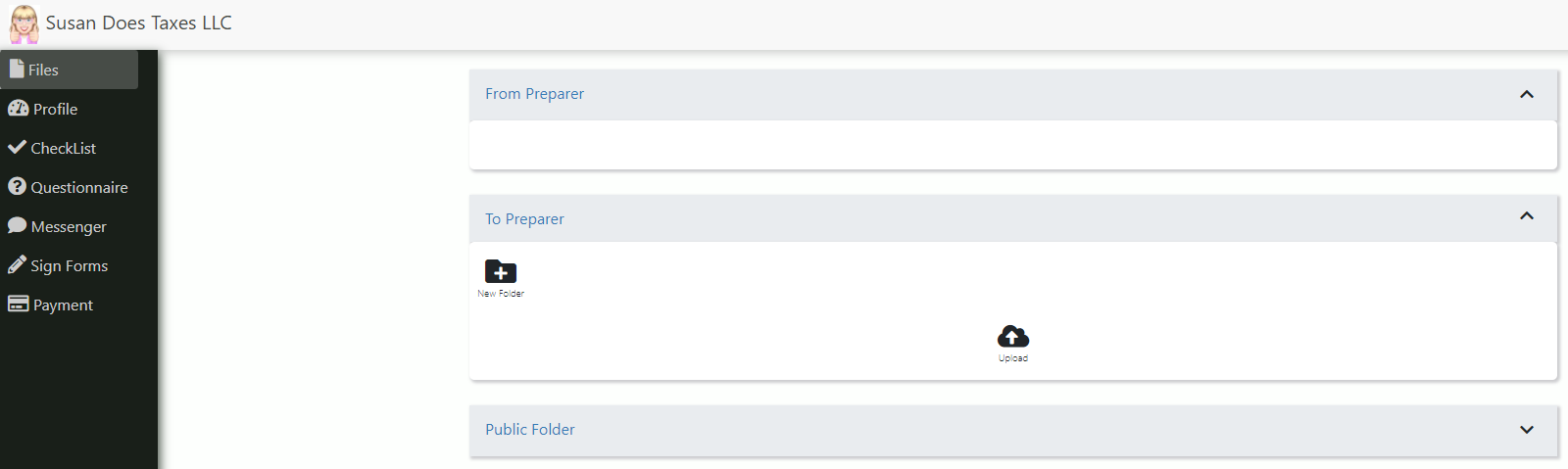

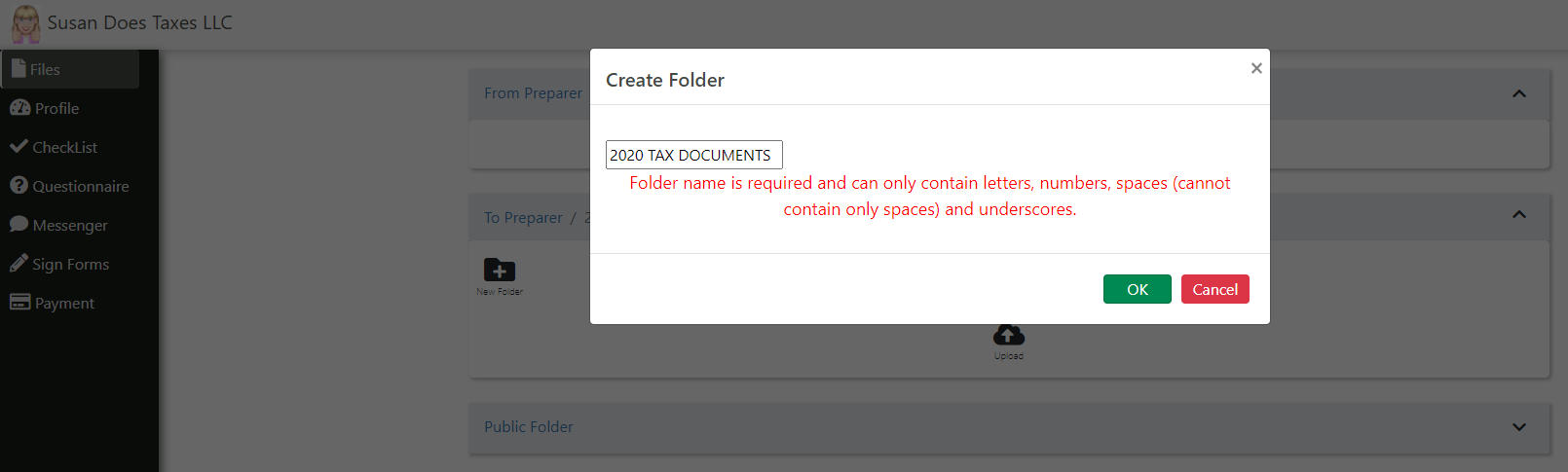

5. You will be redirected to the Portal where you can easily upload digital images or PDFs of your documents. If you need to keep data separate due to multiple years of filings, etc., you may want to create a folder with the applicable year and file contents.

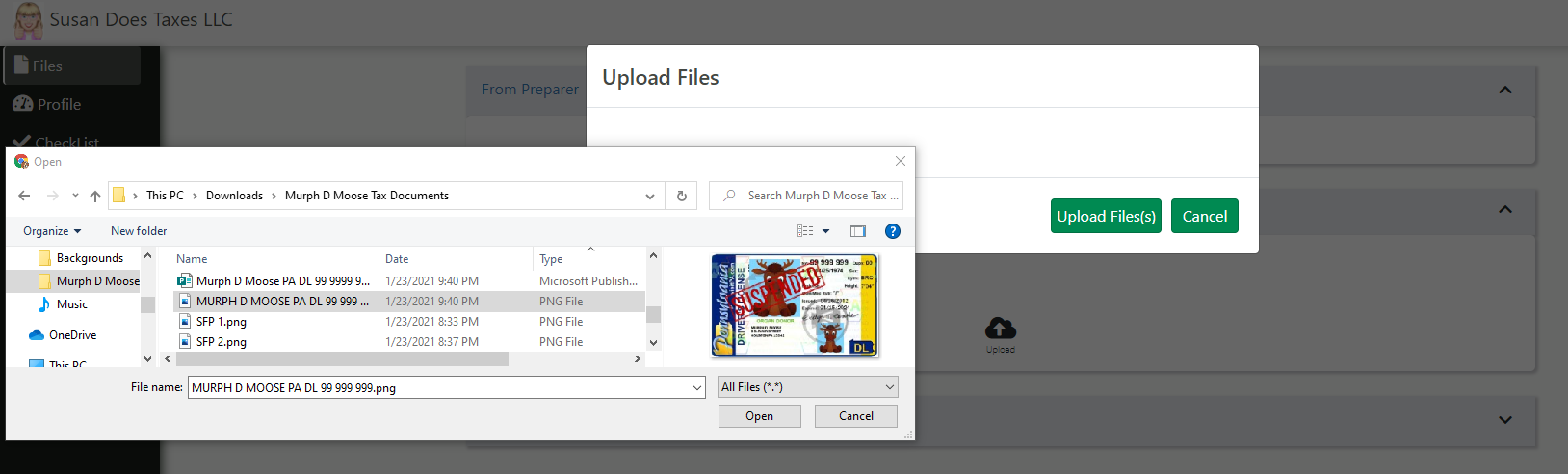

6. Upload your files. It is extremely beneficial to name your files consistently. For example, MURPH D MOOSE PA DL 99-999-999 is the scan of Murph D. Moose’s driver’s license. If you have multiple documents of the same type, added notes in the file name will ensure that everything is entered appropriately. If you have dependents with similar names, consider adding their last four SSN digits (Murph D Moose x6789 W2). If you have any questions, call or email Susan@susandoestaxes.com or use the Messenger option within the Portal.

7. The Portal will show you the name of each document that you upload to the Portal. As well, a notification is sent to Susan Does Taxes automatically. To ensure that you are considering all possible documents to upload, please take a moment to add information to the Questionnaire. It will capture the information you provide and simplify centralizing your details.

ADDITIONAL INFORMATION

You can add your personal contact information to the Profile section of the Portal, however, it is unnecessary aside from Phone and Email. Providing your Driver’s License scan (and also your spouse’s is applicable) will populate your birthdate, name, and address. Only if your data does not match your License will this additional information be necessary. Check the Information Is Complete box at the bottom when you are finished. You can update this area at any time should your contact information change. NOTE: The DOB/Birthdate section is known to be problematic. Use the calendar drop-down option to select your birth date as opposed to typing in your month, day, and year directly.

When your return is complete and it is time to sign your documents prior to filing, you will be contacted that documents are ready within the Portal. You will have the option to sign the forms and complete the process. Also, if any information is missing or questioned prior to completion, the team at Susan Does Taxes will reach out to you for clarification.

We thank you for your trust and desire to keep COVID exposure limited through digital document filing. If we can ever be of service, please do not hesitate to reach out at your convenience.